Coping For The Trees 🌲 | QPOL Issue #32

How a newly crafted CPI method just makes the Fed's job of raising rates easier.

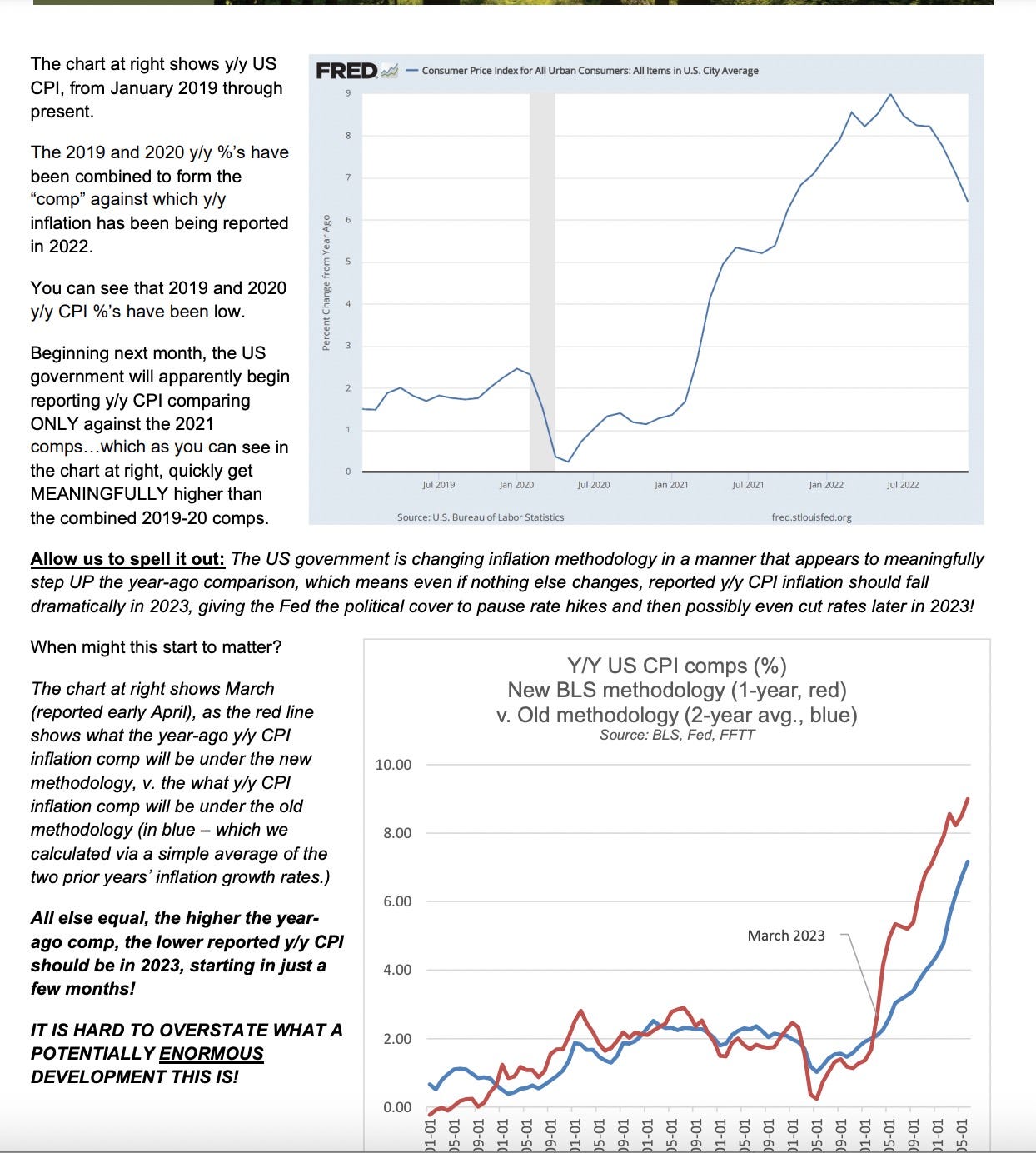

The following image is leaked from Luke Gromen’s newsletter, Forrest Through The Trees. The graphic depicts a new method of calculating CPI which would make CPI much lower than it actually is.

The methodology fudges the way CPI looks which will push it further south. I’m assuming these people think that means the Fed will pivot sooner rather than later with this manipulated metric.

I think not…

Powell wants to end the Fed Put and this is the greatest opportunity for him to break the investors who are arrogantly still in denial the Fed will come to their rescue. It would be in the Fed’s benefit to keep raising rates as this manipulated CPI metric pushes inflation further South. For the Fed to keep raising would be the ultimate method of getting through the market’s thick, stubborn, arrogant skull that Powell is finally breaking the Fed Put. Raising rates will be the wake up call that daddy Powell doesn’t give a flying fuck about the markets.

The entire market is still in denial that the Fed is going to save them in an economic crisis. Pivoting would undo all the credibility they’ve worked so hard to restore whatever is left of it via this monumental change in monetary policy (which I’ve covered in issue #2 below).

Is Gromen hoping this will allow the Fed to cut rates in early 2024 like he says? Or is he hoping it happens sooner?

According to Luke, this change will take effect by the April CPI report (for the month of March). It will reduce the old CPI by 2-3% with the potential of lowering it down between 2-4% (old CPI would be 5% for example). Gromen sees rate cuts occurring as early as late 2023 and early 2024 at the latest.

Considering the current and unprecedented monetary policy, this forecast is ridiculous. I feel like Luke and others of this thinking are still in denial about Powell breaking the Fed Put. It’s thinking like this that gets people way too excited about the recent uptick in markets by the Friday the 13th close, especially in Bitcoin. Many are failing to realize that most of this a mix of a couple things: lower CPI, but most importantly capital flight from an economic hemorrhaging Europe.

Yes, I’m grateful for this nice little pump However, it might not be sustainable (especially in Bitcoin), when looking at quarterly performance. We’ve never seen not just Bitcoin, but all assets trade in REAL markets without cheap funny money. With an aggressive and hawkish Fed we haven’t seen since Volcker’s Fed in the 80’s investors and commentators in the space need to understand that the game has definitely changed. As Luongo says, “personnel is policy”, and the personnel behind the Fed are not the same globalist commies of the past like Bernanke and Yellen who deliberately sell out the American economy for selfish colonialist interest. Beware.

Cutting rates at such a dovish pace that Gromen proposes is not only preposterous, it would completely all undo the progress the Fed has worked so hard to make since last June and arguably before then. It’s wishful thinking to the T but, we’ll just have to wait and see won’t we. Cope harder.. I think they’ll hold after 6% or 7%. That’s what Fed officials have said and just by watching what they’re doing I think it’s safe to say that these people are, in fact, NOT stupid.

As I’ve said countless times in this rag, Powell will take any positive market sentiment and run with it as reason to continue raising rates. Historically the Fed doesn’t “pivot” until the savings rate is ~ over 7%. We’re nowhere close to that and I don’t see things changing in the next 24 month. I could be wrong though. One thing is still certain. Powell and his colleagues (most of his colleagues) at the Fed know exactly what they are doing: bringing America it’s monetary independence back home.

~ Phil Gibson

Nooe

Raise enough and you don’t cover your interest expenses. You break the bond market .