How Powell’s “Bailout” Saved the American Banking System | QPOL Issue #41

It’s not a bailout/QE. Here’s why.

As a primer of the following events, I’d highly recommend the following piece from my colleague Dom who was instrumental in helping me understand this whole mess.

Onward…

The Fall of SVB

First of all, Silicon Valley Bank wasn’t even a bank. In fact, now ex CEO Greg Becker lobbied heavily NOT to be a bank. Had SVB been legally characterized as a SIFI (see link below)

https://www.investopedia.com/terms/s/systemically-important-financial-institution-sifi.asp

they would’ve had to abide by similar regulatory standards normal chartered banks followed. Danielle DiMartino Booth covers this in the following interview.

Instead, SVB operated as a non-bank (shadow bank). In reality. SVB operated more as a hedge fund for various companies in tech, ESG, and other dressed up money laundering projects fronted by the WEF et.al. As a shadow bank, they were able to print Eurodollars indefinitely. Here’s how it worked:

SVB ultimately runs its funding the way Startup funding does:

A person with $1b comes in and puts $1b into SVB. They go out to a startup and sign a term sheet. This sheet says that the startup will deposit its money in SVB.

Then SVB goes out and loans that $1b out to another VC. Who 'invests' it in another startup, who's term sheet says they will keep their deposits in SVB.

So now SVB has take $1b dollars and made it $2b dollars. Without any fed regulation or intervention.

Now if you do this over years and hundreds of startups later, can you begin to see why the Fed didn't like SVB.

SVB were printing money out of thin air behind the Fed’s jurisdiction to fund globalist projects. Just like FTX, the Fed had to take them out. This started as the Fed began raising rates and began weakening SVB’s balance sheet. Why? Because SVB was holding treasuries as a hedge. However, when the Fed Funds Rate began rising, their value began to diminish. SVB C level executives began selling their stock weeks before the final collapse of the operation. Once the damage was done, discussions of a “bailout” began.

The BTFP

The effects increased rates had on treasuries were having impacts on not just non-banks like SVB, but regional banks nation wide. The solution Powel and the Treasury came up with over the weekend was the BTFP. This was merely a compromise Powell had to make with Yellen (Davos), in order to destroy another machine that created eurodollars domestically beyond the Fed’s jurisdiction.

The Bank Term Funding Program (BTFP) https://www.federalreserve.gov/monetarypolicy/bank-term-funding-program.htm

is basically a collateralized loan program regional banks take from the Fed’s discount window (going to the Fed’s discount window has historically been a bank’ “walk of shame”). The banks post their treasuries as collateral with the Fed and get enough money to cover losses and have a year to pay back their principle plus interest.

For SVB, their depositors are made whole of their accounts were insured, but not the uninsured (accounts > $250k), and the Davos investors of the bank won’t get their equity back and the assets they had will be worth pennies on the dollar when the commercial banks bid on them. That’s why it’s a hit job. For SVB, Basically FDIC insured accounts are saved, uninsured aren’t. Basically the fall of SVB and the chain reaction/fall of Silvergate and Signature was a hit job done by the Fed and the New York boys via raising rates. SVB was a Davos “bank.”

As for the other banks, the “FDIC infinity” just means the larger commercial banks may be charged higher fees should the regional banks need more help. Either way, Powell’s monetary policy is bringing a bunch of treasuries back home for the banks to buy all the collateral they need as countries like China sell theirs.

https://www.rt.com/business/573087-china-dumping-american-debt/

Why It’s Not A “Bailout”/“QE”

This move is not stimulative. No excess units were created. this wasn’t a pivot and the banks aren’t starved. They’re recapitalized with treasuries at par value. Why are they at par now? Because of course they’re par if they’re from the USG/Fed in the first place. Banks took a collateralized loan that they’re expected to pay back plus interest over a year.

Should a bank fail to pay back the loan, it would default as a deadbeat borrower and lose credibility. They’d go tits up and fail as a business (as it should be in capitalism). It’s not extra liquidity injection because it’s filling a whole, not creating additional units of currency.

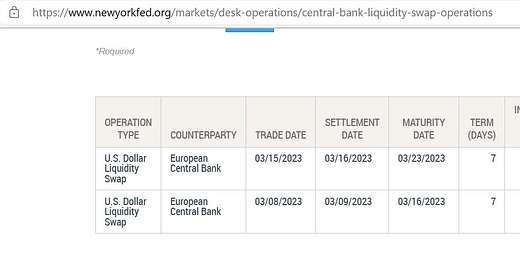

By the way, you know the recent swap lines the Fed is doing with the other Central Banks?

It’s pretty much the same program, just at the Central Bank level. Although it’s an un-secured loan (as far as I know), these central banks still owe the Fed back principle and interest. The Fed is basically profiting off bridge loans from the ECB on a weekly basis. That’s how desperate the European Central Bank is.

Rebooting the American Banks and Economy

Regional banking in the US is on its way to being more robust than ever. Money is LEAVING money market funds and moving into banks. Because of this, banks will be able to pay their depositors interest as their deposits because their balance sheet holes have been filled with their newly par-valued treasuries.

Powell basically did to the treasury markets domestically what he did with the Reverse Repo facility. And so higher/real market rates will cause treasuries to stay in the US because they’re more profitable than anywhere else globally, which will create an inshore dollar market rather than an offshore one.

Thanks to SOFR, it’s completely drained the LIBOR markets. The banks will be more robust and the ones that fail will fail (but they’re just the regional we’re talking about here, and this strengthens the banks in general). This wasn’t perfect, but it was as necessary, and definitely wasn’t a “bailout”, nor QE. It simply had to be done as part of the Fed’s goal of monetary independence.

Remember, the banks couldn’t sell their treasuries to market because their value decreased as Powell raised rates. That’s just how it works.

Therefore, the banks had a hole in their balance sheet since those treasuries were becoming depreciated assets.

Now since the Fed backstopped those treasuries at par, the banks no longer have holes in their balance sheet and can now withstand hikes if Powell continues to raise rates in order to break the next offshore dollar ponzi/his war against Davos for US monetary independence.

Special thanks to Dom, Gail, Tom, Mike and Jim.

~ Phil Gibson