How To Execute A Soft Landing | QPOL Issue #59

A theory on how institutions are normalizing the yield curve.

As I’ve covered multiple times before, Europe is economically crippled against rising interest rates in the US. It’s a battle of capital flow and credibility. my colleagues and I have argued that Yellen at the Treasury and Lagarde at the ECB have to do yield curve control to protect credit spreads. Specifically, Yellen is issuing short term debt that is getting sold which then inverts the US yield curve.

Yield Curve 101

Inverting the yield curve ruins US credibility. Ideally, country’s yield curve should have a nice gradual upward slope (representing a bond’s yield) from left to right. This is important because it tells the market when inflation is higher relative to time. In the future, inflation should be theoretically higher, and thus so should your yield curve (signifying the interest on the bond/payout). The interest on a bond makes it so you make your money back (thanks to inflation) on the original investment on the treasury

Bond prices and interest payouts (coupons) on said bonds work numerically in opposite directions. Meaning:

Low bond price = high rates/coupon

High bond price = low rates/coupon

The higher the rate, the higher the risk.

Naturally, higher duration debt (10 year treasury for example) should have a higher interest rate, meaning a 2 year treasury should have a lower rate. If the opposite occurs, then you have an inversion. This means that inflation is projected to be higher presently than it will be in the future and your yield curve is therefore inverted.

An inverted yield curve with a mix of COVID 2.0 propaganda is a globalist recipe to try and force Powell to pivot back to the zero bound. This either freezes US capital, or sends it over across the pond to Europe. This then helps Lagarde manage the credit spreads on the German 10 year, or protect the euro. As I’ve explained before, she can’t do both. Regardless, there’s a coordinated effort by internationalists to try and sell out the US economy and work against Powell’s monetary policy of higher for longer interest rates which would assert both America’s monetary and National independence against globalist outfits working against US sovereignty.

Sitting On Gold

At the same time, and what may seem contrary to the background mentioned above, it could also be argued that said yield curve control is benefiting what I call “team Fed” on the short end of the yield curve right for the time being. Why? It’s all part of the higher for longer strategy. They (sovereigntist-minded/America-first plutocrats such as Dimon, Powell, and their delegates) are gradually raising rates over each duration of treasuries issued through leveraging the repo markets to short US debt to increase rates over time.

It’s the non-bank actors working on the behalf of the Fed and Powell and Dimon that are using the repo facility to take out leveraged positions on treasuries in order to normalize the yield curve. This is part of the strategy of how to execute a “soft landing” on the macro scale for the survival of America and the global economy in the long run.

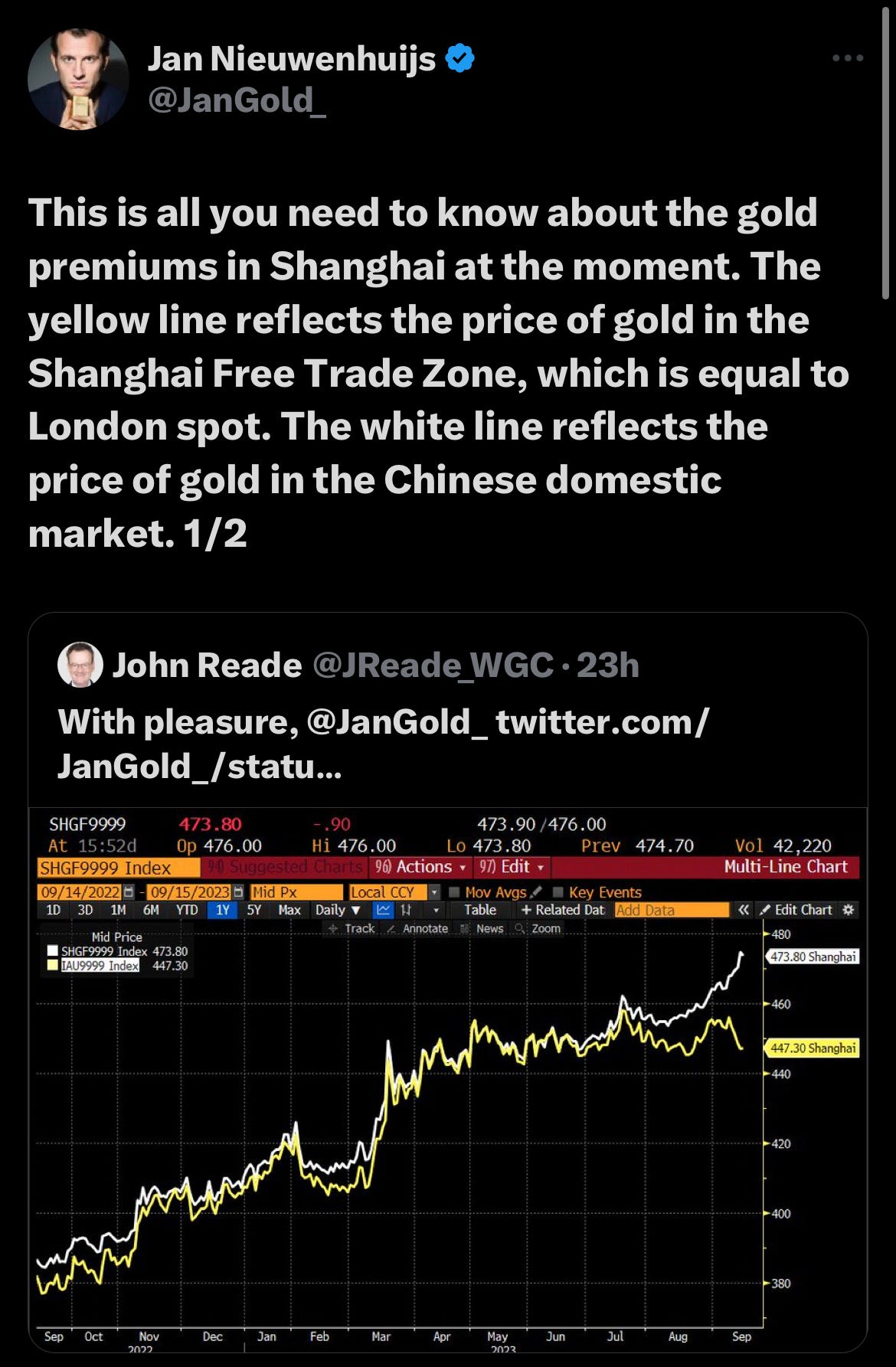

This strategy could also allow them to let the price of gold rise gradually during this process as well in order for them do get more dollar liquidity too to use in their shorting…and perhaps even bitcoin for that matter. Remember, the Fed is coming into a position where they can let the price of gold rise because they are the ones in control of the price now, as well as their coordination with other countries and their exchanges. More and more precious metals are being drained from the COMEX, which allows team Fed and their partners (like China perhaps, as demonstrated below) to sit on the gold price when needed, and let it rise on their watch, not Europe’s.

Europe is in the hot seat because they don’t have collateral, nor do they have the markets and deep pools of liquidity that America does. Again, there’s a reason Soros pulled his funds out of Europe…

Letting the price of gold to gradually increase and use it as a piggy bank for dollars to continually leverage 99:1 to short treasuries. (Btw, Is this not a form of domestic Eurodollar creation by team Fed?)

A Leveraged Soft Landing

There’s lots of leverage happening in the repo markets, perhaps both foreign and domestic. Hedge funds or any financial entities are getting cash from the repo facilities and leveraging on the CME, leveraging at 99:1 in fact. For more details on the mechanics of all this, I recommend this thread from Conks.

https://x.com/concodanomics/status/1701733616005566894?s=46&t=IPq_vRSnPZokRJFmdbsW1Q

The theory is that non-banks and other financial institutions may be using the repo facilities and leveraging the CME in order to short short-duration debt. They’re positioning themselves to trade against short end of the yield curve, further causing an inversion with hopes of forcing Powell to pivot back to the zero bound. they’re shorting more of the 2 year and longing the 10. This trading activity is increasing, Leading to yield curve control for ECB/German credit spreads.

One argument is that what if they’re trying to invert the yield curve on behalf of Yellen/Lagarde?

The Strategy:

1. Foreign bidder (indirect bidder) buys short duration treasury at auction.

2. Then takes said treasury and uses it as collateral in the repo market to get cash.

3. Then uses said that said cash to buy futures contracts at the CME to short the short duration treasuries at 99:1

But is it really the Davos trolls doing this trade? What if it’s team Fed?…

~ How to execute a soft landing ~

As you can see in the chart above, the 4 month debt is at the highest yield. That’s what I would call a “good start”, but team Fed has to move on to the next duration of debt to gradually fix the curve. How?

Steps to normalize the yield curve:

1. Leveraged short positions on treasuries over time (higher for longer point by point of issuance)

2. and letting the price of gold increase to fund dollar liquidity for executing trade and

This increases the incentive to buy on the long end. Gold is there to keep the dollar liquid - AKA (gold is your piggy bank for you to sell and get dollars).

*Can’t use oil instead of gold because increased oil price will break families and the economy - faster oil price might catalyze a higher gold price. So it’s a race against time.

Dimon has recently been signaling to the market not buy US debt anymore. Why you may ask? Because doing so messes up their strategy and hard work of normalizing the yield curve through their leveraging scheme…

This is Dimon saying “stop buying our debt because we’re trying to raise rates and normalize the yield curve.”

In an ironic roundabout way, Yellen and Lagarde are helping them (unbeknownst to them) in the beginning by selling the 2s and buying 10s. It doesn’t help entirely though, just at the beginning phase. But you gotta start somewhere and then push it up over the timeline. It’s doesn’t help if it stays that way because what Yellen and Lagard are doing is keeping the US yield curve inverted in order to protect German credit spreads (protect the ECB/Eurozone).

All the US debt and yield curve FUD narratives are working to Dimon/Powell et.Al’s advantage to raise the yield curve and normalize rates. Once again, higher for longer in a different hue.

~ Phil Gibson

If you enjoy the content, consider supporting my work for less than what a blue check mark on twitter costs you… 🙂

For more insights and musings, follow me on Twitter @MrPseu

For business inquires, contact heyQPOL@gmail.com

Tip Me on CashApp/Bitcoin:

bc1qhlqefvm3f6mc33k7shgzns299wsgzc9jd9puxs