Migrating Through The Golden Age | QPOL Issue #73

What happened, what’s happening, what will happen. Or not.

Happy New Year, everybody. Hope you all are well and had a wonderful Christmas and holiday with your loved ones. Thank you for remaining patient with me regarding the lack of output during my absence. I’ve been busy the past few months with a few things that have been a bit demanding of my time.

Most notably, I’ve become a licensed banker. As you can imagine, studying for 3 FINRA exams and a state insurance exam is quite tedious. It’s all given me a bit of perspective on the industry though and hopefully will become valuable in the coming QPOL issues and the rest of my career. In a way, I feel like my career is finally starting.

It’s been one helluva journey to get here, and I’m excited to enter this new chapter of my life. In fact, the whole world is entering a new chapter: the Golden Age of America. We’re gonna dive into that briefly today, and I’m sure throughout the year as we see what the new administration has to offer the country and if Trump actually gets done what he gets done what he promised. Onward.

Prison Camp for the Saints

The enemy tried to drive a wedge issue between Trump supporters with the H1-B visa debate. Although it’s a valid argument, it’s notable how soon Elon backed off of it, and Vivek is no longer in the board of DOGE. I trust that you’re adult enough to look into the twitter debacle yourself, but I wanted to cover the issue a bit more in depth because an issue it is indeed. Before we start, a quick hat tip to my friend

for the following information from an interview he recently had with Jayant Bhandari. He gives his perspective on the H1-B crisis as an Indian himself and how big of a deal it is to preserve the culture of a nation. See link below.Now, Bhandari argues about 2/3 of the world are animalistic and care only about power, survival, and sex (1/4 people in America are Indian).

They have No moral compass. No 10 Commandments. They envy & hate the West for what they don’t have, so they come to the US as vengeful parasites to ruin our culture. Be it cheating on tests, fake resumes etc, they don’t care, and they get off on it.

The most sadistic part about it is that regardless of a lack of moral compass, these invaders do understand that misery loves company. They bond over their hideous situation. That’s why they can’t separate from their 💩 streets. They know their situation is worse back home, yet they need to bring a part of their shittiness with them to have a sense of unity.

Corporations welcome it because it’s cheaper for them than hire heritage Americans. Those who speak out sacrifice all they worked for. That’s why no change has been made. Fear.

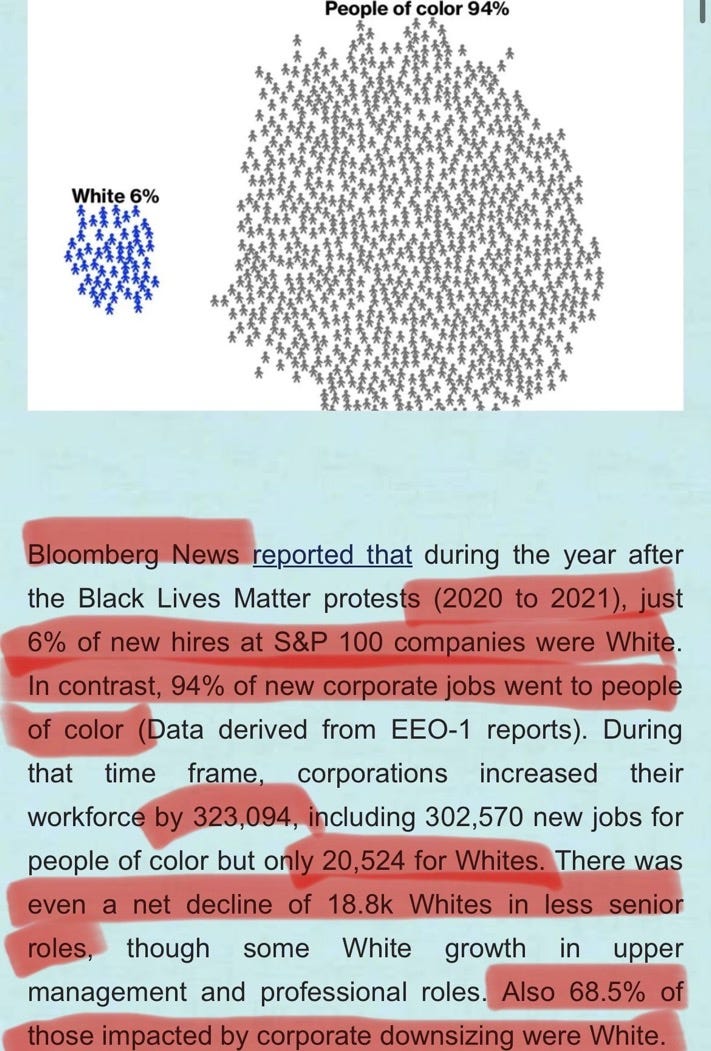

These invaders have no moral consciousness, and take advantage of our own. We’ve become our own worst enemy with this virtue signaling, wokeism, DEI, etc. The results? Only 6% of new hires in America across industries are white.

Shout out to my man Stormy for the visuals below 👇

The irony is that the same people (neocons) who told us to go kill brown people across the world because “they hate us for our freedoms” are the same ones importing brown people who ACTUALLY hate us for our freedoms with such a vengeance, they’re happy to take our jobs and ruin our culture and country.

Here’s another cheery anecdote…

Are you paying attention yet, anon? Have I struck a nerve? How does this change?

The truth is that it’s already changing, and has been for a while…

Elon won’t get his cheap labor for a few reasons. Mainly, interest rates. The Fed will start lowering rates, but I’m not sure. It’s obvious to understand why they want cheap labor when rates are high. Why else did Facebook and countless tech companies layoff people 10s of thousands at a time? They’re costly and wasteful useless eaters of payroll.

So honestly H1-B only works with the offshore dollar market, which is getting reigned in. And even if we lower rates here, it’s doesn’t matter because we’re on SOFR. It’s the new law of the land.

Just like with endless wars, overthrowing governments, and rigging elections, H1-B fraud can’t happen when ZIRP is gone and there aren’t any free Eurodollars to leverage. You can thank Powell at the Fed and Uncle Jamie for that one.

Remember, monetary policy happens on a 6-12 month lag…

Higher interest rates = America First.

is it really what the tech bros want, and are they gonna get their wish?

Macro Strategy

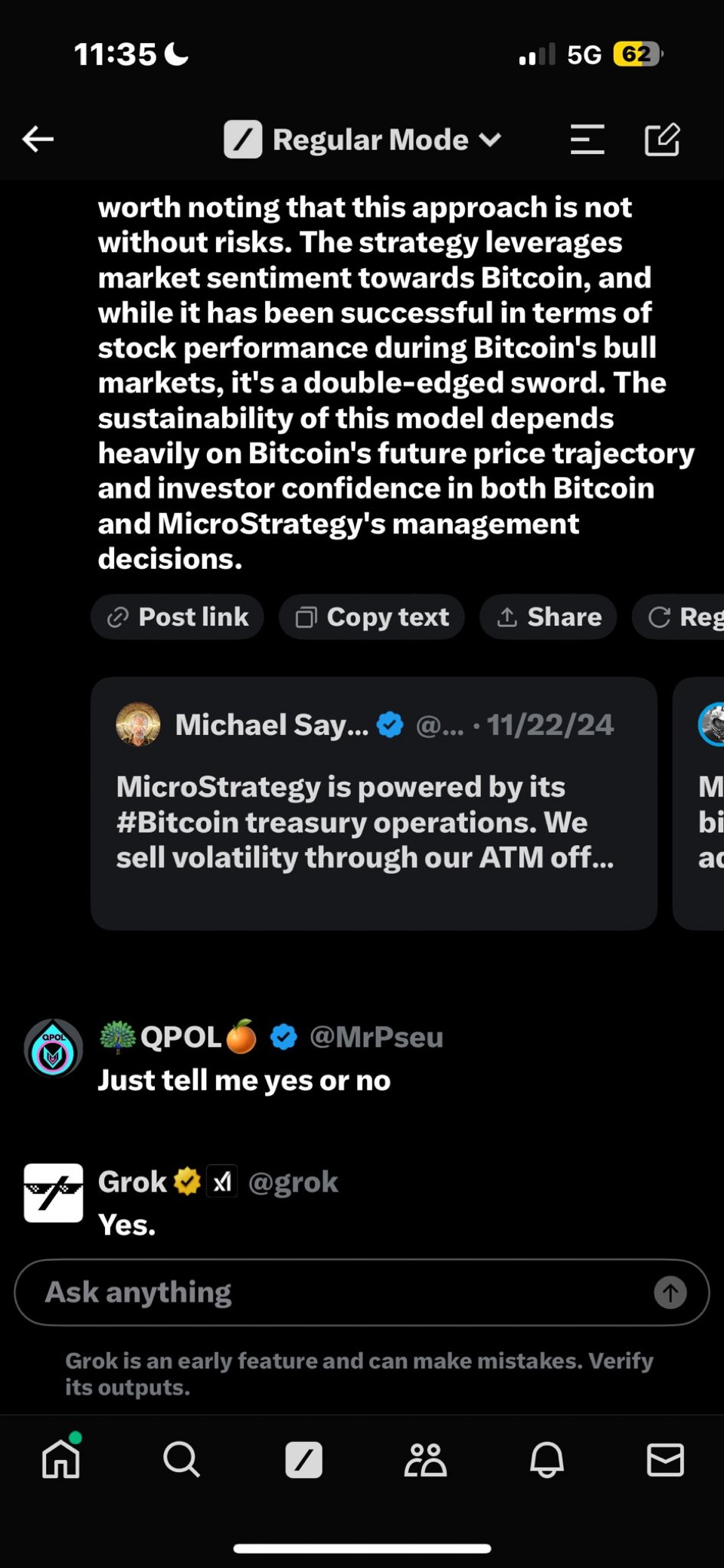

If you haven’t been paying attention to what Michael Saylor’s Bitcoin strategy has been with his company MicroStrategy for the last 5 years, lemme fill you in…

Seems Saylor keeps diluting $MSTR shareholders…

Saylor issues more stock to take investor money. He then buys bitcoin with said investor money at the top as a marketing strategy. The announcement will be “MSTR buys $5B more worth of bitcoin!” Or whatever…

Same jig with issuing 0% debentures. Similar outcome, different spin…

Their freshly diluted stock goes up, keeping board members and shareholders happy. Though they ARE a data analytics company, they’re no Oracle or Tableau.

Some even argue they don’t actually produce anything of value to provide to the market and consumers, other than a speculative play on Bitcoin and blazing the trail of using Bitcoin as a strategic reserve asset for corporations and governments to have an infinite money printer (which is bad ass).

It’s all gravy as long as number go up and investors and the BOD are happy. Now just apply that to the nation state level…

Not saying it’s going to happen, but it’s a greater than 0 chance. Rumors have been going around for years that Saylor is the proxy for the US bitcoin supply. If the Trump administration is serious about leveraging Bitcoin as a strategic reserve asset, Saylor ain’t a bad place to start. Given his history, wouldn’t surprise me if he is a “fed.” I’m all for it.

Regardless orange coin likes orange man…

But you wanna know who’s really calling the shots in the Trump administration?

The Dimon Administration

For all intents and purposes, Jamie Dimon has been behind the Trump campaign, and that’s a good thing.

You watch this interview yet? No? You should. There’s a reason Luongo calls Dimon the default Secretary of State. He’s speaking for the admin, Wall Street, and the woes of the average American. We need a better economy, and we’re gonna get it.

As Stormy Waters has said (and I agree), many people just aren’t sophisticated enough to noticed the wins when they’re right in front of them

So if you aren’t sophisticated, get there. If not, stop complaining.

I was able to learn this stuff. If I can, anybody can. It’s not that fucking hard FFS. Nobody should be hero riding the admin. It’s full of opportunistic politicians. But their shortcomings will be outweighed by what they were placed there for. We will hold their feet to the fire as we always have.

But Trump winning and why is a completely different, revolutionary shift given the fact Jamie Dimon ran his campaign. Jamie Dimon and Powell at the Fed run the financial world. People who want to know what’s actually happening NEED to understand this and how crucial this is to the entire plot. It doesn’t get talked about or is easy to understand because if it was, the true enemy would lose their shit and chaos would ensue.

You need this slow burning of controlled chaos and pain felt by the enemy to occur as it has been. A slow bleed. Gradually and strategically.

If anyone thinks an occupied government isn’t going to negotiate and appease their occupiers for as long as they have to, then they clearly don’t understand optics and politics.

Meanwhile, the occupiers can’t last without free offshore money (which they don’t control anymore thanks to SOFR). Real tangible change won’t be seen or felt by We The People overnight…

But as a wise man once said, if you’re not sophisticated enough to understand what’s actually going on, then STFU and remove yourself from the conversation.The people in charge are the ones that turned off the free globalist money spigot, because that’s what Israel relies on. The Eurodollar system.🚰 That world does not align with the agenda of rebuilding America to protect the Wall Street cash cow (JP Morgan).

Get a clue.

The evidence is very simple. It all ties back to the Eurodollar system and collateral and who controls it.

But it’s monetary policy and happens on a lag. So each new change or development in said policy that’s implemented with take 6-12 months max to really be felt. And the pain that’s felt won’t always be felt by you, the lowly pleb trying figure out the truth of what’s really going on because you’re being distracted by smut on the timeline that either leads you down rabbit holes, or gets the best of your bias and assumptions.

Why? Well, since the enemy doesn’t control the money, the only thing they have control tell of is the media. They are trying to influence your thoughts by appealing to your biases, and half the time the loudest voices doing it don’t even know they are half the time. It’s because they see the same baited story and run with their narrative, which is then picked up by the people on twitter or wherever else you are trying to be the fact checkers staying on the pulse of what they think the “truth” is that the enemy is trying to hide.

It’s all a big fake and gay bait and switch distraction that leads the people to feel demoralized and black pilled. As

would call it, “strategic blackpilling.” Yet, the factual problem remains that both parties lack the sophisticated understanding of what is actually happening.There is no left. There is no right.

Theres only interest in sustainability and preservation of power. I know there’s a lot more going on than just money, But you need the money to do that stuff. Trump isn’t the good guy, He has people telling him what to do. He’s a meat puppet. We need to understand his puppet master is Dimon and what Dimon wants actually protects the country. It’s not the best situation, but it’s the best outcome given the world we live in.

Back to School: The Economic Rub

“We have been closely monitoring the geopolitical situation for sometime, and recent events show that conditions are treacherous and getting worse. There is significant human suffering, and the outcome of the situations could have far-reaching effects on both short-term economic outcomes, and more importantly, on the course of history. Additionally, while inflation is slowing, and the US economy remains resilient, several critical issues remain, including large fiscal deficits, infrastructure needs, restructuring of trade and materialization of the world. While we hope for the best, these events and the prevailing uncertainty demonstrate why we must be prepared for any environment.”

~ Jamie Dimon to colleagues on Q3 2024 Earnings

My takeaway from Uncle Jamie deciphering from polite CEO terms:

“JPM’s got plenty of money and more people keep coming year after year - For Q3 Asset Wealth Management, management fees rose 15% and long-term net inflows hit a record of $72 billion.

We’ll be fine, but the economy is fucked because of these globalist assholes that still think Powell’s bluffing. Trump better get in and start cutting taxes and the budget.

Meanwhile the hedge a possible WWIII, buy gold and commodities (AKA, all the collateral they don’t have) so we starve and bleed these bastards out.”

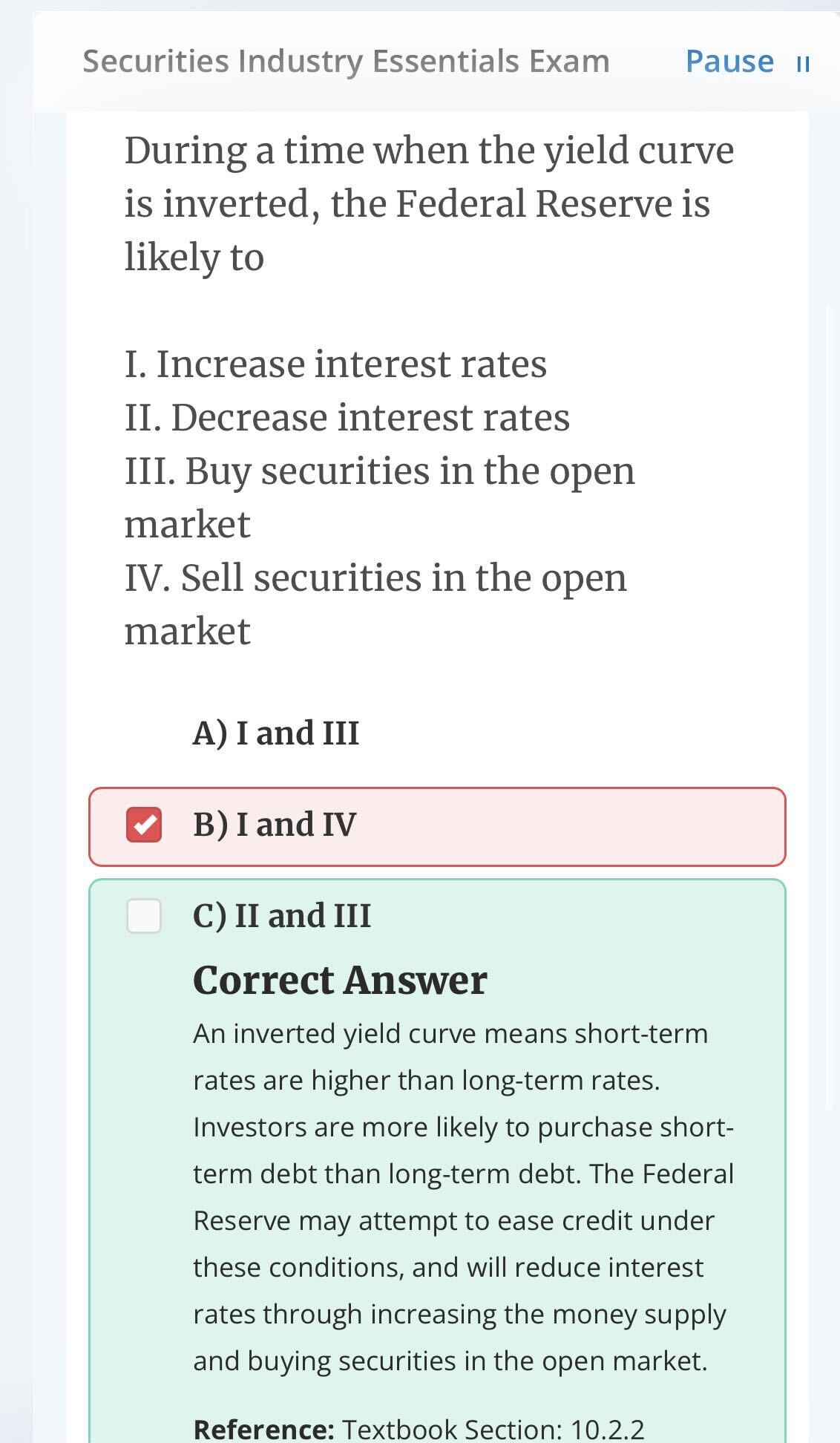

Unwinding The Yield Curve

Explaining the rigging of the Yields and where we’re now allowed to go from here…

As a general principle with trading any bond, the spread/difference between yields indicates a bond’s liquidity. The tighter the spread, the more liquid the bonds are. That’s why US Treasuries generally have the lowest bid–ask spreads on a daily basis.

Treasuries are globally the superior form of collateral that people trust they can park their savings in because they trust the US. They can also use these treasuries as leverage for more dollars.

Traditionally, a widening of bond yield spreads indicates a flight into quality bonds. This should mean people buy more US debt than German debt.

The problem is the US yields have been higher than German yields, which is ludicrous because it implies it’s riskier to own US debt than German debt.

America’s super power is that they’ve NEVER defaulted on their debt. They always pay their creditors interest and return their principal.

Germany (and Europe in general) required negative interest rates to survive and has no collateral to leverage. That’s one reason why they want to be the monopsony (only buyer) of oil from Russia.

The EU essentially has nothing of substance other than the bread basket of Ukraine (that still isn’t part of the EU), their Eurodollars (which they can’t print willy-nilly anymore because they’re indexed to SOFR instead of LIBOR), and propaganda smear campaigns to virtue signal climate change and brow beat how terrible America is.

So they’re stuck with propagating lies in the media and manipulating their bond spreads thanks to the YCC coordination between Yellen and Lagarde. As Yellen keeps issuing (selling) 2’s and buying 10’s (also done by Europe and Britain to hypothecate those 10’s most likely for Eurodollars), she’s inverting the US yield curve to not only make us look bad, but falsely signal a recession to force Powell to eventually pivot back to the zero bound (which will never happen).

Remember, Solvency isn’t their goal. Their goal is to default and do a CBDC. They just want that to happen to the US first so they can absorb all the capital flight out of the US and into the EU.

The US inversion in the yield curve HELPS Chrissy because it signals recession. Even though recession looks plausible and the US economy is screwed because of seemingly endless spending under Yellen, the fiscal situation can reverse with spending cuts, gold-backed treasuries, and continued higher/normalized rates.

That economic improvement doesn’t happen without Trump getting in.

Don’t Second guess the fundamentals, second guess reality.

The fact I got this question wrong says a lot about the world in which we live based on current on-goings, vs what’s taught as securities markets orthodoxy.

If you don’t hate Janet Yellen yet, you should now.

Europe is broke and ran by commies. The world trusts America with their money more than anywhere else. The commies occupying our government are trying to run it into the ground so people stop investing here and money flees into Europe and the UK instead. That will never happen because we're America. We have the deepest capital markets and superior resources. Europe/British Empire remnants want to rape and pillage us and “take their colonies back.” Powell made their job harder by raising rates. And knee-capped them by making being able to control the price index of dollars by moving away from LIBOR and replacing us with SOFR.

So, that gives the rest of the world confidence in the US economy. Strong dollar means commie enemies are losing. You should say, “thank you Papa Powell and Uncle Jamie for saving me from eating the bugs in a pod!”

Say thank you, Pappa Powell and Uncle Jamie.

Now with Janet Yellen out of the picture, Powell has started un-fucking her YCC inversion by cutting rates. What does this mean? Has he caved and pivoted from his hawkish stance? Has SOFR indeed failed and the Eurodollar junkies have successfully forced his hand? No.

The fed has control of the short end of the curve. Cutting moves it down, while the long end will stay about the same. So cutting should move rates short-term rates below the 10 year (AKA: above tjw Fed Funds Rate).

I personally always overlook this aspect, but cutting to affect the short end is still in a sense a method of controlling the long end to normalize the yield curve. However, as my mentor Tom Luongo warns, primitives matter. It’s important not to overthink all this. The more you do that, the more you build a foundation of knowledge on top of sand.

The Fed is the short end of the curve. It's influence wanes as you go out duration. This is why the 30 year is a mostly free market absent YCC or QE. Thus, (at risk of repeating myself) cutting normalizes the yield curve, as the Fed only has control of the short term/short end of the curve; shorter duration debt.

All this to say, Powell’s tweaking on the short end allows for the free market to do its thing, normalize the yield curve, and increase even more market confident in American sovereign debt. Not to mention Treasury secretary Bessent is keen on the Crown’s failed attempt to have a global clearing house for US treasuries which would undo everything Powell et.al has done with SOFR. The enemy is losing the war…

The Golden Age of America is here. The sovereignty of the nation is in the hands of patriots who are tired of seeing her get sold out by traitors. Time will tell as enter this new age. I’ll be here to count the blessings of wins we face, as well as hold those in charge accountable. I look forward to you joining me, typos and all.

On with the show.

~ Mr. Pseu

If you enjoy the content, consider supporting my work for less than what a blue check mark on twitter costs you… 🙂

For more insights and musings, follow me on Twitter @MrPseu

For business inquires, contact heyQPOL@gmail.com

Tip Me on CashApp: $TipPhil