Same Old Song and Dance of Ponzi Hit Jobs | QPOL Issue #40

How the Fed took out Silicon Valley Bank.

Get yourself a cooler, lay yourself low

Coincidental murder, with nothing to show

With the judge, constipation will go to his head

And his wife's aggravation, you're soon enough dead

It's the same old story, same old song and dance, my friend

As I posited publicly back in November, the collapse of FTX was a hit job by the Federal Reserve to destroy the offshore dollar markets and Davos money laundering operations. Anything in direct competition with the Federal Reserve system and their control over monetary hegemony must be taken out. No competition without their control, oversight, and jurisdiction. This tweet sums up the recent Silvergate/Silicon Valley Bank blow up perfectly.

The is the impact Powell’s monetary policy has on the war against Davos. Remember, the source of their power and influence comes straight from the ODM (offshore dollar markets), which is what Powell aims to if not destroy, reign in full control over by:

Raising rates to collapse their leverage and make their eurodollars expensive to “print”

Remove their ability to leverage/”print” up said eurodollars by sucking out base 0 money (reserves) via foreign Reverse Repo Facilities

Control the price of eurodollars by phasing out LIBOR and re-indexing them to SOFR

100% this was the goal: to have JP Morgan and team Fed gain control of the crypto industry because the House of Morgan’s MO has always been monopolies.

If there’s gonna be an ODM, then they need to be the ones in control of it. So not only will they control the pricing of the ODM via SOFR, but the issuance of both the fiat and crypto dollars as well.

So What happened?

Everything went to shit for these shadow banks as Powell started raising rates.

The Outcome?

Although the depositors get saved, the shareholders of SVB get screwed. Raising rates and causing the crumbling of SVB save thee customer and punished the enablers. Adios SVB and all the zombie companies it supported. This is part of the cleansing and market neutralization Powell is trying to achieve.

USDC Gets the Old Yeller Treatment

There’s nothing more offshore than the internet.

USDC was just the next stable coin in line to get taken to the woodshed. BlackRock was in direct competition with the Fed’s primary dealers when they were granted access to the Fed window. Thanks to Davos, Fink was able to LARP as a bank and get a bunch of cheap debt and buy up tons of US real estate and get dibs on the treasuries when they were issued. This access to cheap debt enabled them to “print” more shadow money through outfits like Circle’s USDT.

If anything survives this massacre, it’s tether. USDC was Circle’s (Larry Fink/Davos’) pet project to create what would eventually become the US’s CBDC and an extension of offshore dollars. As I’ve said before, Powell doesn’t have a problem with Bitcoin. What he has a problem with is “crypto” and stable coins. That’s why JP Morgan practically own the Ethereum network (or the largest companies most involved with it). They want to control crypto and be in charge of anything that competes with the dollar. The House of Morgan will do anything to maintain it’s dominance.

Taking out both FTX and SVB was another step and the final nail in the coffin to prevent Davos’ goal of installing a CBDC. Silvergate was the infrastructure. Jaime pulled a hit job. As I’ve said many times before, so long as Powell is in control of the Fed and sets precedent for America’s monetary policy and financial standards, there will be NO retail CBDC. Earlier this week, we saw Powell basically speaking up against this Davos plan to slingshot the MMT monetary policy that would collapse the power the commercial banks wield over the US economy…

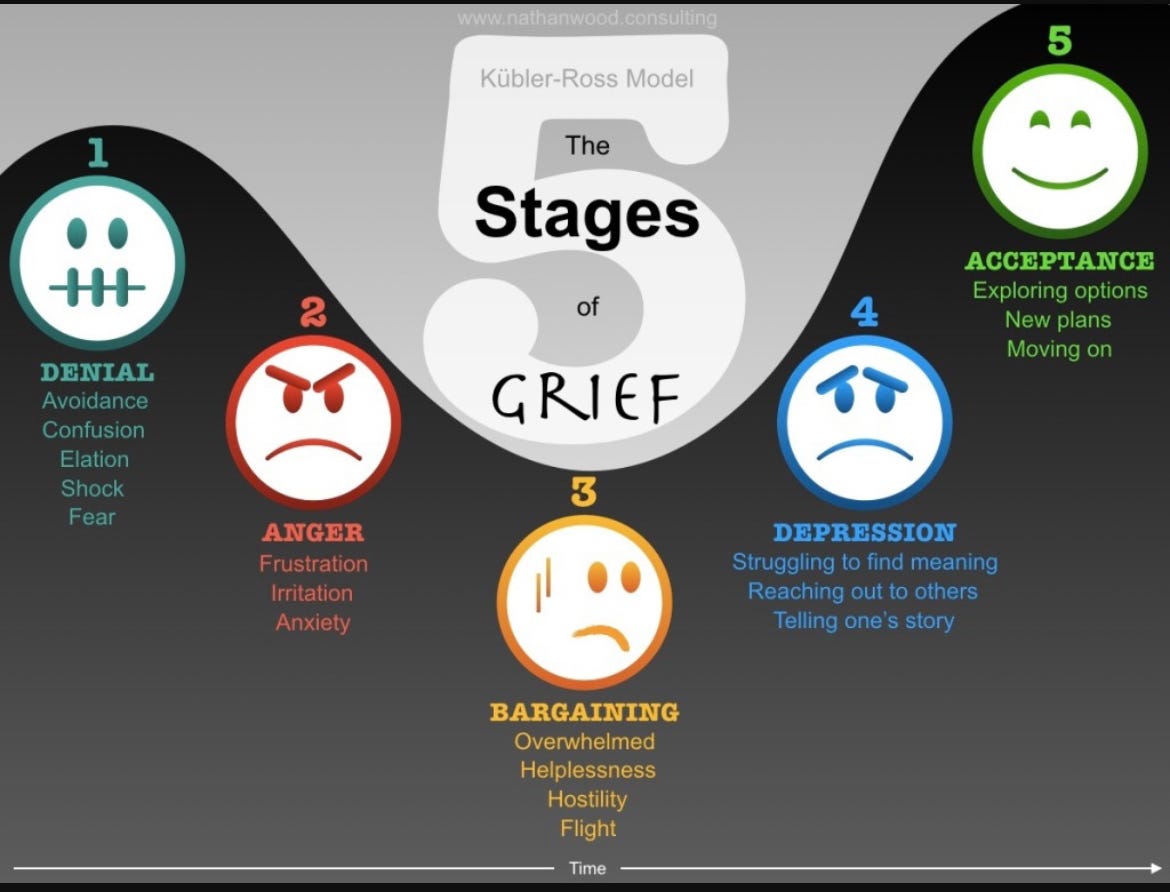

Suffice to say, it’s really no coincidence this stress in shadow banks like Silicon Valley Bank is showing with the severe loss in LIBOR liquidity. As I covered in last week’s issue, LIBOR is basically dead. Hence the propaganda that the Fed should pivot is rampant as we near the next FOMC meeting in less than 2 weeks. The financial commentariat and the markets are in denial about Powell breaking the Fed Put, and will bicker like insufferable, feckless children until they get through all stages of Kubler Ross’ grief cycle.

Although I keep clamoring everyone is in denial, at this point I think we’re somewhere in between stage 2 (Anger) and 3 (Bargaining).

Bill Ackman’s comments have tainted the financial commentariat of a bailout and the Fed being forced to pivot. No surprise, but this isn’t about inflation. The big kicker is that since the investors of SVB won’t be made whole, this’ll be a major deflationary event and a major win for the Fed in destroying shadow dollars and gaining monetary independence. It’s all part of the plan, but it’s just the same ol’ song and dance.

Fate comes a-knocking, doors start locking

Your old time connection, change your direction

You ain't gonna change it, can't rearrange it

Can't stand the pain when it's all the same to you, my friend

Here’a the live version, because who the fuck doesn’t like seeing some good ol’ Rock N’ Roll in all its pure, raw glory?

~ Phil Gibson