The Rise and Fall of Sam Bankman Fried: The SUM Report 11-13 | QPOL Issue #20

The Saga of FTX and the war for global monetary control.

The scandal of FTX is undoubtedly the biggest story of the year, if not the decade. An excellent recap of this saga can be seen in the tweet below.

This piece however will take a deeper dive into the nuance of what really happened and why.

Who was involved and what were their motivations?

Who benefits from what, and who suffers?

What does this mean for society at large and why should anyone care?

This is NOT just another story about a ponzi scheme going bust. The fall of FTX has drastic implications and consequences for the powers that be of the world and whether or not their dominance on the global stage will remain. FTX going down was just a chink in their armor.

What Happened? A Quick Summary:

A Scammer is Born

FTX/Alameda Research (ran by Sam Bankman Fried, or SBF for short) is a hedge fund that recently bought out Terra Luna, Voyager and BlockFi (exchanges/crypto projects that went belly-up earlier in the spring).

SBF’s ethos and motivations stem from utilitarianism and a new school of thought, Effective Altruism (EA). EA-ers basically believe that in order to achieve the maximum good for society, one needs to make as much money as possible by taking the largest risks. Once said money is made, it needs to be given back and invested in the less fortunate parts of the world for the greater good of humanity.

This EA craze is just a front for similar ideals which fall in line with the scholars and Malthusian ideologues running the World Economic Forum (WEF). Macro/Geopolitical commentator Tom Luongo has coined these global communists as "The Davos Crowd”, or simply Davos. The ties and connections to those running Alameda and Davos run deep:

Very deep…

A thorough and elaborate write up on this ideology, SBF, and the Saga of FTX was published on Sequoia Capital’s website but promptly removed after recent events regarding Alameda.

An archive of the scrubbed article can be found here.

Sam’s Laundry Casino

In order to make all his money for his altruistic passion projects, SBF created the crypto exchange (FTX) that would in reality act as a front for globalist money laundering. The genesis of the idea came to SBF when he noticed inefficiencies in crypto exchanges. SBF took advantage of these arbitrage opportunities in the crypto market, realizing he could buy Bitcoin for $10k in the US and sell it for $11k in Asia on exchanges like Binance. SBF was able to receive funding from Sequoia and FTX was born.

The tool to launder money would be a ponzi token (FTT) which SBF would pump up hype for on such media outfits like Bloomberg. FTT was then used as collateral to borrow billions of actual dollars (like offshore dollars?) that couldn’t be paid back and used the money to buy up all the failing crypto companies (Voyager and BlockFi) that went bust to build up his crypto empire. It was during this time he was hailed by talking heads like Jim Cramer as the “J.P. Morgan of crypto.” Rather than yield harvesting, FTX were debt harvesting by buying all the failing crypto exchanges that were selling yield products to clueless retail investors.

Like many ponzi exchanges, FTX didn’t actually sell crypto to their customers. Needless to say, FTX was insolvent despite the claims (lies) SBF made on twitter. People were just simply buying IOU’s on the platform. Had everyone removed their crypto to cold storage into their own self-custody, there would have been a run on the bank(man).

Going Down: CZ’s Motives

That bank run finally happened when competitor CZ (CEO of Binance, the largest crypto exchange in the world), took to twitter and collapsed the price of FTT after he announced Binance would begin market selling their holdings of the token.

Just days after the announcement, $16 billion of investor (money launderer) and customer wealth was destroyed.

CZ is something of a crypto tycoon genius. There’s no single headquarters for Binance. There are multiple structures of the company set up in Asia, the US, and elsewhere all following different jurisdictions. He’s basically protected himself from regulatory capture of foreign powers which allows him to offer such leverage products. This tactic didn’t stop SBF from approaching CZ and making a deal with him to list his FTT token on Binance in future hopes of going after CZ’s world-rated #1 crypto golden goose.

Usually these shitcoin casino owners will make a coin and get their buddies in on the pre-mine so that when it hits the market and retail buys into the FOMO propaganda, the big whales holding all the bags will just sell all their shares. It’s a classic pump and dump where retail is the last one holding the bags of shit they were falsely advertised.

Knowing that the FTT token was worthless, CZ decided to stab SBF in the back and sold his bags. SBF was basically forcing as many exchanges as possible to be compliant to US securities regulations. CZ was essentially trying to escape the soft-power control SBF would be imposing on him as being a vassal of American regulation overseas. So CZ called his bluff, knew FTX was insolvent, and started selling his FTT bags to bankrupt FTX.

So CZ is being an outright savage and is going after SBF’s lunch? Was this any different than any other demolition buyout? Was this just like how J.P. Morgan bought out Bear Sterns during the Great Financial Crisis of 2008?

Yes and No. After doing a bit more homework and some time had passed, CZ probably decided that buying out FTX wasn’t such a good idea…

Beyond Compliance? SBF’s Motives

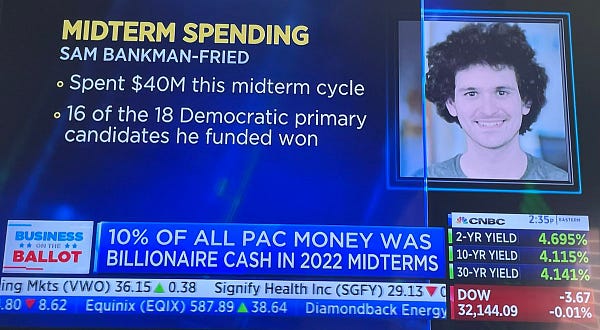

To recall back from the spring, SBF was being hailed as the JP Morgan of crypto when he was bailing out all the failed projects in Spring of 2022. He was compliant to the T with regulators and is arguably quite compromised, seeing that he’s gone on television with Bill Clinton and similar ilk, and is the largest doner to the Democrat Party only second to George Soros.

The extensive political donations SBF made were of course to pay off Davos to be to compliant and keep the ponzi/laundering party going. However this collapse of FTX was not just controlled demolition as an excuse for further regulation on the entire crypto industry. It should however be noted that such plans have been in the works for some time now as seen via the Voyager merger lead by SBF. The merger indicates that:

"This merger gives Voyager the ability to service the 750 million European population with the most consumer-friendly agency brokerage platform for investing in crypto assets," said Steve Ehrlich, Co-founder and CEO of Voyager. "We look forward to our international expansion as Voyager's growth continues on all fronts, with AUM growing rapidly and our product offering continually enhanced with debit and credit card, margin, and more traditional banking products on the horizon. We look forward to making Voyager a truly global company and having Gaspard de Dreuzy lead the integration efforts in Europe."

So yes, there’s no doubt SBF was pursuing global compliance and regulation for crypto as a front for Davos. That regulation will come eventually, but with FTX being Davos’s crypto cash cow going bankrupt, such plans have been put on a hold to say the least.

The Election Connection & Rebirth of the Offshore Dollar Market

The expected “Red Wave” did not come to fruition during the midterm election in America. No surprise. As expected, the Davos/globalist outfit that runs Washington stole the election via offshore dollar money which funded voter fraud (via FTX). Therefore, Davos doesn’t want Powell to stop raising rates because they’re worried about a recession, they’re worried about their leverage being destroyed. I have laid out extensively how and why raising rates as well as multiple monetary tools are destroying the creation of offshore dollars here for reference.

CZ’s Binance was Archegos Capital Management 2.0. In simplest terms, CZ Evergranded FTX. China let Evergrande fall to destroy the soft-power control that Soros had over China’s economy. China’s controlled demolition over their realestate sector destroyed millions of Soros/Davos money. The exact same thing happened with CZ working against SBF. He sunk the FTX stable coin (FTT) Team Fed pulled the plug on FTX before Davos could.

As I mentioned in last week’s SUM Report:

There’s a tacit coordination with the US banks and Russia to take out the EU.

The Fed is starving them of dollars.

Russia is starving them of energy, and now food because they pulled out of the grain deal with the UN.

Ergo, Powell and Putin are coordinating to bankrupt and starve Davos.

Now add China into the mix. It wouldn’t shock anyone if CZ has certain ties to China. Destroying Davos money is in China’s best interest because they and the rest of BRICS don’t want a World War III with the EU. Nobody benefits from war. Destroying Davos’s money is the only way to avoid such a conflict, but won’t go down without a fight to preserve Ukraine and defeat Russia.

Ukraine is not a country. Ukraine is just an extension of Davos’s global commie banking system and money laundering operations to fund their stranglehold of global chicanery. This money laundering operation must survive if Davos wants to be successful in destroying the United States. Their banking system of offshore dollar creation and laundering operations is their source of power. FTX was merely an extension of said power.

Summation of Monetary Order

If you’ve read this far, it goes without saying SBF was owned and operated by Davos as a front for Offshore Dollar Market (ODM) money creation and laundering through Ukraine and beyond the jurisdiction of the Fed. Davos used SBF and FTX as the tool for regulatory capture of the entire crypto industry. They need to control the industry in order to control stable coins because stable coins are the replacement of the ODM/Eurodollar System.

The ODM is being destroyed as Powell raises rates and bankrupts Davos. Therefore Davos’s only hope was to capture the entire stable coin market so they can keep printing more money to fund wars and overthrow governments (and steal the midterm elections).

Knowing CZ/China couldn’t be captured since Binance is not under any national jurisdiction, Davos tried buying him out via pumping up FTT. CZ called their bluff and bankrupted them by sending FTT to zero to escape soft-power control over the Davos outfit that was FTX.

This sent a shock wave throughout the contagion of all 134 Alameda firms and the greater crypto industry. The entire market crashed especially as firms were forced to sell their Bitcoin holdings to make good on their liabilities. The only way Davos really wins is to force the Fed to pivot. At this point, the Fed will only pivot if the US is forced into WWIII by the Brits (like the previous World Wars) against Russia and China.

This is why Powell needs to bankrupt the Eurodollar market/Davos before a false flag occurs. As the offshore dollar markets are being drained through rate hikes, Davos took to stable coins instead. CZ crashing FTX was him doing Powell, the Fed/their shareholders the NY banks a solid. Tether alone is at least 35:1 leveraged. Below, Mrs. Booth is referring to the leveraged loan market (AKA the offshore dollar markets/ODM).

CZ/China might not be friends with team Fed but they're temporary allies because BRICS & American sovereigntists don't want WWIII. Davos (euro-colonialist-commies) do. It's the only way they get their Great Reset and take over the world island as they've wanted for centuries.

Powell doesn't have a problem with Bitcoin, he has a problem with stable coins. Stable coins are created beyond the Fed's jurisdiction, & therefore are the evolution of the offshore dollar market which the Fed aims to destroy to preserve credibility & monetary independence. This is a war for monetary order and national stability.

~ Phil Gibson

Just found you from your recent interview, and read several of your articles, which got my brain going. I know I'm dropping too many questions, and appreciate any reply, or maybe one would make a good article.

The NY banks are famously some of the prime movers of NYS politics - is the Powell/Davos tussle a big reason for the strict NY crypto regulations and BitLicense?

And is the Elizabeth Warren anti-crypto crusade a part of this struggle, or is it unrelated? It looks like most politicians - on the surface, anyhow - approach crypto ideologically; to wit, as with most things, the Dems with strict regulation, and portions of the GOP more free market. But that almost seems like some of them are working against their other interests, e.g., why would the Dems want to shut down their giant slush fund? I'm sure it can't be that simple. Or maybe it's different party factions, idk.

Thanks for reading.

Very interesting and informative article. I have a few questions.

First, how exactly do stable coins affect the ODM? I understand how dollars are multiplied outside the US, via Fractional Reserve Banking, but how are stable coins the same as bank deposits? What is the layman's explanation?

Also, what do you think about SBF's vocality on twitter? It seems un-ponzi-scheme-like to post a 33-tweet thread explaining yourself. https://threadreaderapp.com/thread/1591989554881658880.html

Thanks for the article,

Boniface